Back in 2020, mankind had to deal with a threat it never saw coming. As COVID wreaked havoc across the globe, chaos and uncertainty shrouded over the business world.

According to the World Economic Forum, the pandemic resulted in one of the biggest supply chain crises the world has ever seen. Even today, almost three years after the pandemic started, its impact on the global supply chain is still evident.

As the situation with COVID began to improve, the global supply chain started to regain some of its pre-pandemic vigor. However, that’s when the Russian-Ukraine conflict began to unfold. As reported by GEP, this conflict pushed the global supply chain towards another major crisis.

The Global Supply Chain Crisis: A Growth Opportunity for the Insurance Industry?

There’s no doubt that we’re living in an era of frequent supply chain crises. It also seems that the situation of our global supply chain is unlikely to improve any time soon. In such circumstances, businesses relying on these supply chains need the support of insurance agencies.

That’s because only proper insurance can protect these businesses from suffering losses as they try to overcome the challenges of supply chain crises.

While the overall situation is a sorry one, it does open up an opportunity for the insurance industry. As the need for insurance grows, an insurance business can expect more customers looking to insure their companies.

Thus, if you’re running an insurance agency, any global supply chain crises is also your opportunity to help your insurance business grow. The question is, how can you grow your insurance company in such times? Let’s find out.

Tailored Coverage for Supply Chain Resilience

In an era where supply chain disruptions are becoming commonplace, insurance agencies must cater to the specific needs of businesses grappling with these challenges. Collaborate with underwriters and risk assessors to develop tailored coverage options that address supply chain vulnerabilities.

Consider policies that cover business interruption due to supplier disruptions, delays, or shortages. This ensures that clients have financial protection when their supply chains face unexpected setbacks.

Highlighting such coverage options can set your agency apart and attract businesses looking for comprehensive risk management solutions.

Risk Mitigation Consultation

The role of insurance agencies goes beyond selling policies. They can also serve as valuable advisors to businesses seeking ways to mitigate the impact of supply chain crises.

Host workshops, webinars, or seminars where you share insights on risk assessment, supply chain diversification, and contingency planning. Educate your clients about strategies like dual sourcing, safety stock maintenance, and leveraging technology for real-time visibility into supply chain operations.

By positioning your agency as a knowledgeable partner in risk management, you can build stronger relationships and foster trust with your clients. As you do so, you can showcase that you provide exceptional service when it comes to providing insurance policies during a supply chain crisis. That, in turn, will bring in potential customers which will further boost your agency’s growth.

You can also seek assistance from insurance agency advisors in this regard. According to INEX Capital and Growth Advisors, these companies tend to dive deep into your agency’s inner workings. In doing so, they can help you develop better policies for those struggling to survive due to supply chain shortages.

As you learn more from these advisors, you can develop risk mitigation policies and strategies for these businesses. When they see such insurance services, they’ll surely come by to consult with you and even seek your insurance products.

Strengthen Networking and Partnerships

Supply chain crises impact multiple industries, creating opportunities for insurance agencies to collaborate with other service providers. Forge partnerships with logistics companies, risk management consultants, legal experts, and technology firms.

These collaborations can lead to cross-referrals and joint initiatives that provide holistic support to businesses dealing with supply chain challenges. By offering a comprehensive network of experts, your agency becomes a one-stop destination for businesses seeking guidance and solutions during turbulent times.

Thought Leadership and Content Marketing

According to Statista, the global content marketing industry is worth $63 billion. All types of businesses rely on content marketing to build their popularity and eventually grow bigger. If that’s the case, there’s no reason why your insurance agency can’t follow the same approach.

Position your agency as a thought leader in the realm of supply chain risk management. Create a blog, podcast, or YouTube video series where you discuss the latest trends, case studies, and best practices related to supply chain resilience. Develop whitepapers and guides that offer actionable insights for businesses looking to navigate supply chain disruptions.

Valuable content will help you attract businesses seeking expert guidance. Additionally, active content marketing can enhance your agency’s online visibility and draw in a wider audience.

Conclusion

The global geopolitical situation is not in a good shape. Apart from the Russia-Ukraine conflict, there are also the US-China tensions. Besides, who knows when the next pandemic will hit or when a major sea route will get blocked. Thus, it’s impossible to rule out another major future supply chain crisis.

Therefore, if you’re in the insurance business, take this opportunity. Of course, you’ll be growing your insurance business this way. However, you’ll also be helping many other businesses survive the supply chain crises that are yet to come.

Supply Chain Crises article and permission to publish here provided by Daniel Washington. Originally written for Supply Chain Game Changer and published on September 6, 2023.

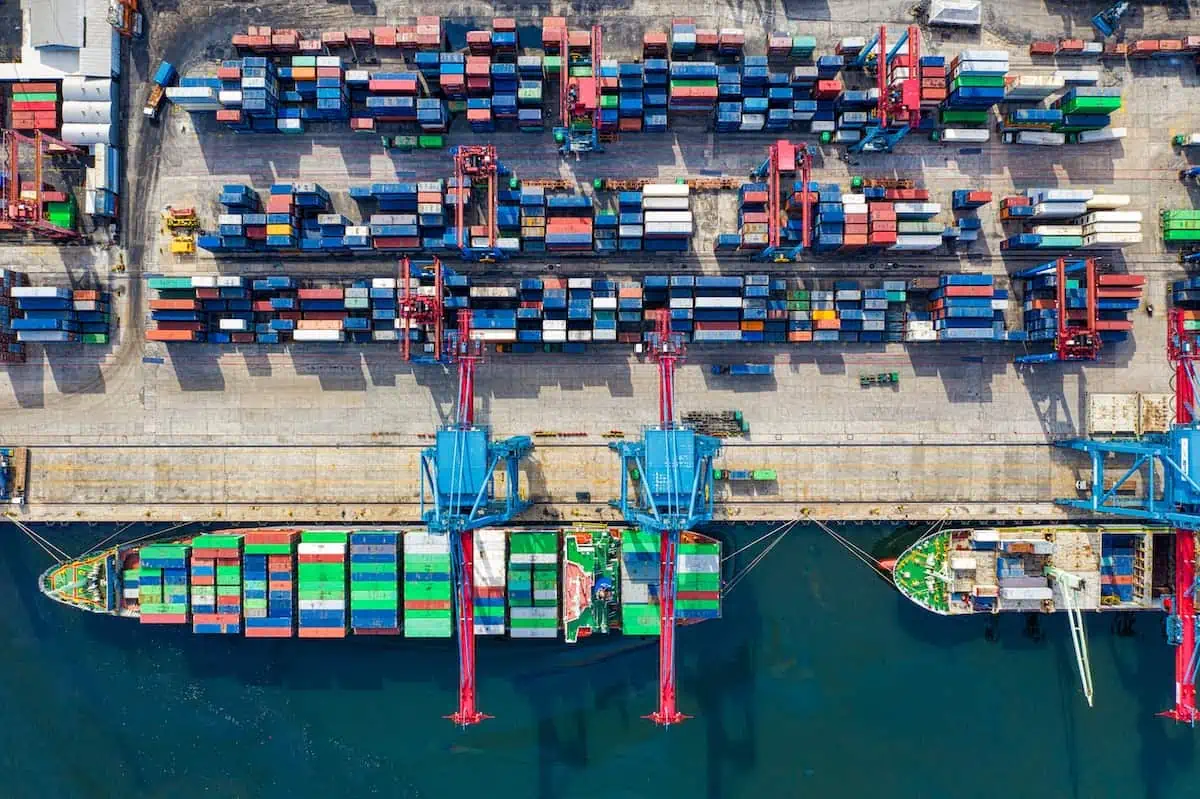

Cover photo from pexels.com.