Your credit report greatly influences your financial future. Maintaining clear, correct credit reports is also essential to properly use credit and maintain the most significant credit scores possible.

You must comprehend how credit reporting functions and what you must do to guarantee the accuracy of your credit reports as a result.

Avoid doing anything that might lower your credit score. It’s more challenging to get authorized for credit cards and other loans without a solid credit history.

Your credit report provides information on your borrowing history and an estimate of your likelihood of making on-time payments.

As a result, you should have a decent credit score. What you should know about credit reports in Canada is provided here.

What Is Credit Score Range Used in Canada?

In Canada, credit scores vary from 300 to 900. The likelihood that you will be accepted for a credit card or loan decreases as your score decreases.

Even if you have been approved for a credit card or e-transfer payday loans Manitoba despite having a poor credit score, the interest rate you pay will probably be high.

On the other hand, a better credit score increases your chances of being authorized for a credit card or loan and lowers the likelihood that the interest rate will be charged.

How Do Credit Inquiries Work?

Equifax and TransUnion are the two credit bureaus that operate in Canada. The lender sends a report on your credit activity to the credit bureaus whenever you create a credit account (such as a credit card, mortgage, or loan).

The agencies maintain track of your personal credit history, which includes, among other things, payment history, credit limits, and credit-seeking activities.

The lender may contact one or both credit bureaus to get this data when you apply for new credit. They evaluate your creditworthiness based on the information in your current credit file. Credit inquiries are what this is.

Your credit history keeps track of inquiries as credit-seeking activities. Lenders may see all previous questions made when they inquire.

Additionally, the issuer of the future card you apply for can view the request from today.

How Do Credit Inquiries Affect Your Score?

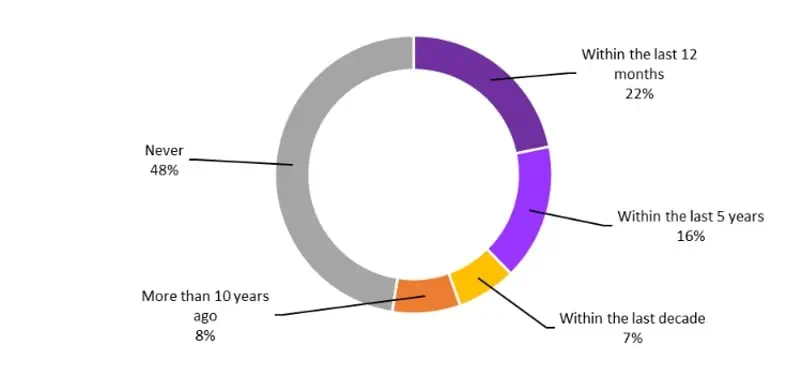

Nearly half of Canadians have never checked their credit score, with only 22% doing so at least once a year.

However, it is dear to you to know how Inquiries affect your score because you can not always control them.

Percentage of Canadians who have requested a credit report and when they have last checked it

Your credit score is determined by proprietary algorithms used by Equifax and TransUnion. Banks also use their own standards to decide whether to lend to you.

It’s preferable to think of your credit score as more of a visible benchmark rather than a precise indicator of how the bank perceives you or the kind of credit cards you’ll be given.

We advise constantly maintaining scores of at least 700 and ideally higher. Your score will decrease by a different amount for each inquiry depending on other credit criteria, but generally, it will increase during the next six months.

In each case, the underlying causes are more important than the actual number.

Soft Credit Check

Soft credit checks are not utilized when applying for new credit and have no impact on your credit rating or score.

You may be glad to learn that, contrary to what you may have been told, pulling your credit report only counts as a soft inquiry.

“Non-credit related inquiries” and “account review inquiries” are the two categories that TransUnion lists. Non-credit-related inquiries, as their names imply, are made for purposes other than determining whether you qualify for a new credit product.

A typical example is getting a soft check as a requirement for a job or rental housing application.

When you order a copy of your credit report for yourself, soft credit checks and the business is conducting them appear.

However, regardless of how many there are, neither your credit nor your score will be impacted.

Hard Credit Inquiry

When you apply for a loan, a hard credit inquiry takes place, and the lender needs your permission to determine your eligibility. Your credit report will reflect this kind of credit check.

When you ask for a loan, a lender will do a rigorous credit investigation to determine your loan eligibility.

Before approving you, lenders must check your credit report to examine your credit history to determine how financially responsible you are.

Your credit score may be impacted if you quickly apply for numerous different sorts of loans since this may signify that you are experiencing financial difficulty.

Credit bureaus often see you as having a higher probability of defaulting on your obligation.

How to Raise Your Credit Rating

Consistently and On-Time Bill Payment

Every month, pay your bills by the deadline. Set up automated payments to ensure you get all the due dates since late payments may significantly lower your credit score.

To guarantee that your payment is completed in time if you pay using online banking, be sure to spend a few days before the due date.

Keep an Eye On Your Credit Card Use

Credit cards (and other revolving credit) aid in credit-building if you can maintain a low credit use rate. A maximum of 30% of your available revolving credit should be used.

Utilize Several Forms of Credit

Lending to consumers who can demonstrate that they can responsibly handle a variety of credit is more secure for institutions.

You should only apply to some loan programs you can find. When selecting loan items, you have to be cautious and picky.

Conclusion

While having a high credit score is unquestionably beneficial, unless you intend to utilize it, it is nothing more than vanity.

Using credit card incentives, anyone may leverage their good credit history for something beneficial.

Now you know the basics about a credit score in Canada and will be able to build it correctly without making mistakes.