One of my first professional jobs was in Warehouse Space Planning and Warehouse Management. You can’t go through a warehouse without seeing pallets. I quickly became very familiar with the standard half-sized and full-sized (40″ x 48″) pallets that the company was using at the time, though I was unaware of the Pallet Supply Chain.

Having been in dozens and dozens of Warehouses, Distribution Centres, and Manufacturing facilities every since I’ve seen pallets everywhere. And while most of us probably overlook them their importance can’t be overstated. Pallets are the standard platform on which virtually all of our goods are moved and stored.

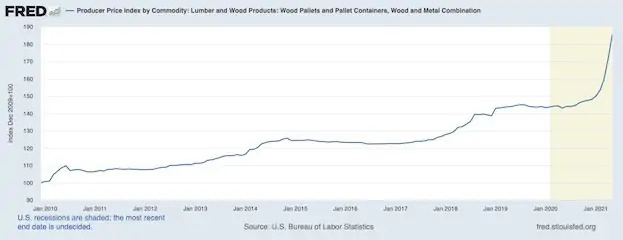

Given the astronomical increases in lumber pricing, the core element of the wooden pallet, we felt it was time to look at the Pallet Supply Chain and the impacts that lumber pricing is having on this industry.

To learn more about how the Pallet Supply Chain is being affected by lumber pricing visit Pallettrackingsuppliers.co.uk.

The Pallet Market Size

According to prnewswire.com the Pallet market is “expected to reach USD 110,565.7 million in 2027, from USD 79,008.6 million in 2019, growing at a CAGR of 5.1% from 2020 to 2027.”

With 7.6 billion pallets used in 2020 the overall consumption is global and pervasive. Note that some reports show that there are 5 billion pallets in use worldwide. Regardless, billions of pallets are used every year.

Market Drivers and Dynamics

Every Warehouse, every Distribution Center, every Manufacturing operation, every Logistics entity, every Retail operation, and every Industrial facility uses pallets. The form factor is standard issue for the handling, storage and movement of large quantities of goods.

Simply put the growth of any of these industries, or any company or facility within these industries, will invariably mean more goods are being processed and hence more pallets are required.

The backbone of the Digital Supply Chain of the future is end to end electronic connectivity and real time visibility as to the movement of goods. Technologies such as RFID associated with pallets will be a driver of intelligent pallet demand in the future.

Those who are interested in creating more sustainable supply chains will drive increased demand for plastic pallets for instance. Despite the higher cost the promise of implementing more environmentally friendly supply chain solutions will be more important and palatable given plastic pallet recyclability.

The perennial growth in E-Commerce, for which warehousing, distribution and logistics is the core aspect of order fulfillment and delivery, all drives greater demand for pallets. The Coronavirus pandemic further accelerated demand for E-Commerce, which in turn translates to more goods and more pallets.

As everyone is emerging from the pandemic this is also driving increasing demand for goods, given that lockdowns and closures depleted inventories. Reestablishing inventory levels means that more and more pallet will be required to hold these goods.

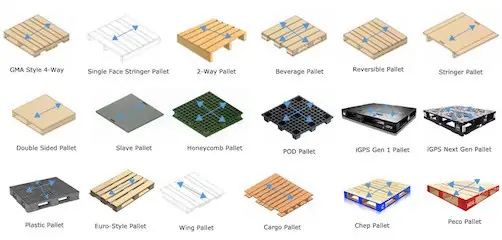

Types of Pallets

Pallets are made with a variety of materials (including softwood, hardwood, plastic, metal, and paper). Approximately 90% of the Pallet market is for wood pallets.

There are numerous styles and sizes of pallets. According to homestratosphere.com, pallets can be categorized “by style (entry points), design (block vs. stringer pallets) and by material.” Pallets may have 2 way or 4 way entry points, may have an open deck or a solid deck, and may have support from either blocks or stringers.

Wood pallets are low cost, reusable, and repairable, and relatively light. Plastic pallets are durable, reusable and light but they are more expensive. And Metal pallets are understandably heavier and more expensive than wood, though they are long lasting and strong.

According to freedoniagroup.com, “Wood is by far the most widely used material, with wood pallets comprising 84 percent of the total stock in 2019 and 93 percent of sales in unit terms.” The increased percent of sales is a function of unit price.

Lumber Pricing Impacts

As previously stated the core advantage of the wooden pallet is price. However the Lumber Supply Chain pricing impacts have resulted in wood pallet costs increasing by 400% in 2020 and 2021. That being said it looks like lumber pricing peaked in May, 2021 and is now on a downward trend.

Wood pallets are still less expensive that plastic pallets, even with the higher lumber pricing. And given that the higher lumber pricing does not appear to be a long term phenomenon, it is reasonable to assume that prevailing pallet Supply Chain market dynamics will favour the dominance of wood pallets for the foreseeable future.

It is worth noting that the cost of labour for the manufacture of pallets has also been increasing due to labour shortages resulting from the pandemic and its associated restrictions. The cost of nails for fastening the wood to form the pallet is increasing due to higher costs for steel and for logistics.

All of this adds up to higher pallet pricing from what we would have experienced prior to the pandemic. But with the rollout of vaccines and countries starting to get back to “normal”, albeit a new normal, it seems reasonable to assume that pallet pricing will continue to decrease at some pace.

Conclusion

Pallets, in whatever form or form factor, are an instrumental and requisite element in any Supply Chain. Just like so many other goods that have been impacted by the pandemic, pallets have not been immune from the virus, as evidenced by the shortage of supply and the rising prices.

While pallets are most often overlooked as a benign, inconsequential item, it is true that without pallets our Supply Chain and logistics would be dramatically less efficient and cumbersome.

EBOOK HERE

EBOOK HERE