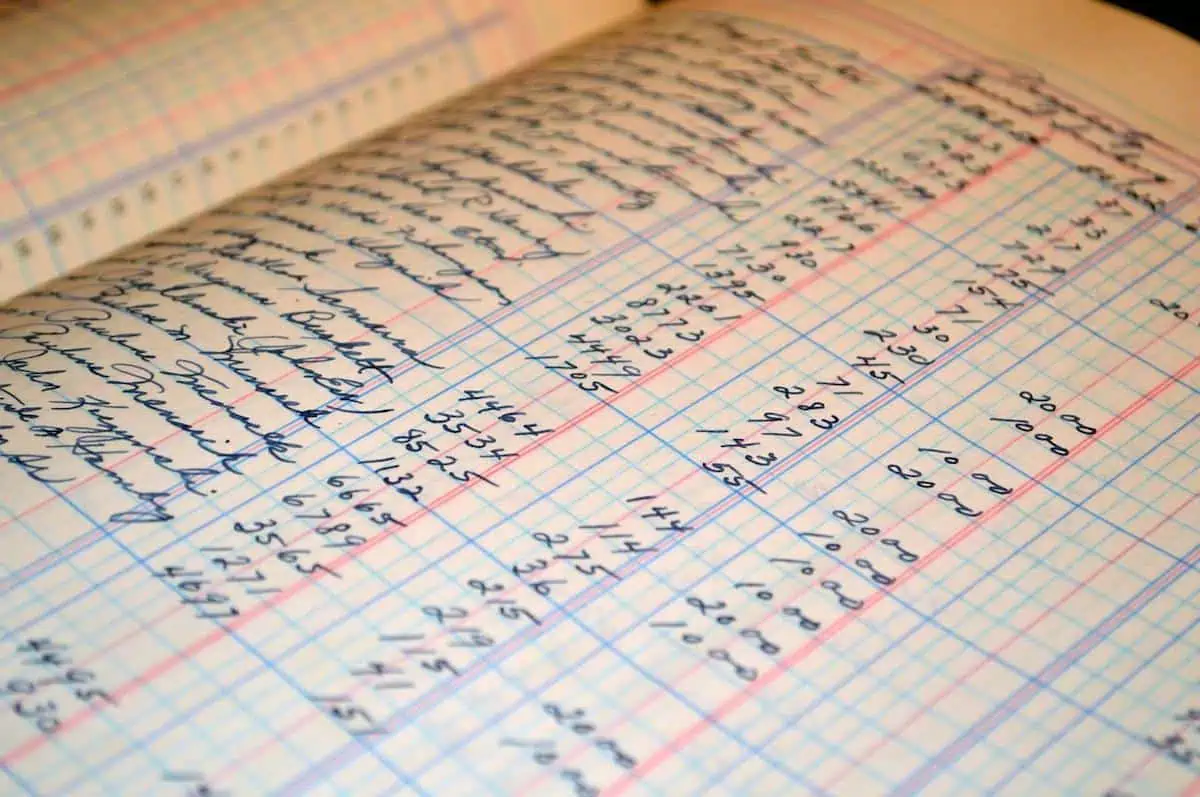

Let’s face it, before now, accounting was boring! As an accountant, you’d have to wait for long, tiring hours to input small accounting transactions. Then there was the dreaded spreadsheet that was used to run reports manually.

Most times, the closing process at the end of the month grabs the full attention of accountants. With this keen concentration on a singular goal, the accuracy of reporting was poor.

Are you tired of spending long hours trying to fix unbalanced accounts? How would you love to see accurate accounts that are always up to date irrespective of the period? Would you like automated systems that can track your purchase order?

This is the future that Continuous accounting offers!

What is Continuous Accounting?

Continuous accounting is an advanced approach to the account management of an organization. It involves the use of automated systems and processes to track accounts and ensure that they are updated on a daily basis. This system of operation does not wait to accumulate data before making records. Instead, all entries are made immediately.

A continuous accounting system provides transparency in an organization. All purchase order terms, accounts payable, purchase requisitions, and other financial moves made can be monitored, and proper plans can be made to fulfill them.

Benefits of Continuous Accounting

A major problem with the traditional system of accounting used by a lot of small business owners is the time consumed during the month-end closing. This leaves a lot of bills, invoices, and receipts unattended during the closing period.

Here are some advantages of continuous accounting;

- Reduced errors: The fact that entries are made daily ensures that they are current. Errors can easily be traced and fixed, as opposed to trying to fix an error while closing accumulated data. This results in reduced errors.

- Real-time data: Accounts have access to real-time data and information. This makes the workforce proactive. This way, opportunities can be grabbed as they come, and changes can be made immediately.

- A more streamlined workflow: Tasks can be performed in smaller batches. The automation eliminates workloads, causing increased efficiency.

- Better decisions: With enough time for closing, the Accounting and Financial Services teams can focus on how to improve. This will certainly improve the decisions that are taken in the organization.

The Continuous Close

This involves using workflows and automated processes to keep books continuously closed. It makes closing a daily activity as opposed to a hectic, pressurized period-end activity. This method rules out the labor-intensive process of accumulating workload and completing it at the end of the month.

For instance, if you make a purchase order using continuous closing, you can immediately account for that purchase order instead of waiting till the end of the month.

Advantages of the Continuous Close

- More accurate data: Closing a pile of data at the end of the month makes the information more prone to errors. A continuous close will eliminate errors and improve data accuracy.

- Easy detection of fraud: Fraudulent actions can be easily spotted with a continuous close. If there was any hideous activity like a hidden purchase requisition, it would be traced with a continuous close system.

- Soft close: In a situation where you need to provide a financial breakdown to your bank or for a purchase order, the continuous close system will give you access to current data.

- Reduced staff burnout: The traditional method of closing can be labor-intensive. This process usually requires all hands on deck, causing employees to take on extra hours and get a higher workload. This usually causes staff burnout and can be harmful to the health of the organization.

- Better compliance: Employees are more eager to engage when the workload is light. More compliant staff tend to be more productive.

Continuous Financial Management

As opposed to the traditional financial management systems, continuous financial management involves making financial plans on the go. In this method, several financial meetings are arranged in a year to evaluate the effectiveness of financial plans that are in motion. With this process, an organization is more flexible and open to financial growth and expansion.

It is in a continuous financial management system that a possibly forgotten Accounts Payable can be discovered, and plans can be made to pay up the debts.

A good financial management strategy makes necessary adjustments to set plans, making them effective in the long run. The financial market is unstable, and plans can easily be obstructed by changed prices.

How to Switch To Continuous Accounting

If your company is still using manual systems to run its account procedure, then now is a good time to make the switch. A continuous accounting system will change your small business or large organization in many positive ways. A digital transformation should be foremost in every company’s plan in 2022. Here is a step-by-step approach that you can follow to make the switch;

- Move to the cloud: If your accounting system is not yet cloud-based, then you need to make the move first. Continuous accounting deals with automation. To use it, you need to be in the cloud. Also, a cloud-based system is perfect for remote working as team members can work from around the globe.

- Connect your bank accounts to your accounting software: Linking your financial account to your financial system enables proper accountability. You can monitor transactions made in real-time

- Automate your expenditure: Seeing your spending insights in real-time will help you make proper financial plans. If the entire process of your spending from start to finish is recorded, you will have an updated financial system.

Continuous accounting is a huge step up from the conventional method. There is no need to suffer long and tiring days of closing manually when it can be done continuously with the aid of automation.

Switching to a continuous accounting system is easy and totally worth it. If you haven’t joined the trend, what are you waiting for?