Importers all over the world are required to use a harmonized tariff schedule code on their products, but what is an HTS code?

Well, it’s a set of numbers, usually between six and 10, that identifies a product so that a country’s government can quickly know what is in a shipment that’s coming to their shores, how much to tax the products in that shipment, and whether or not other agencies need to be involved (for regulated items such as some foods, drugs, alcohol, firearms, and more.

Here’s more on what a Harmonized Tariff Schedule, or HTS, code is and its history.

Pre-Classification Years

Prior to 1950, international trade was fairly simple. There weren’t many products moving back and forth between countries, but that was all changing with the times. Suddenly, there were more products than could be properly tracked and several attempts were made to create a common classification system that all countries would use to make product identification and taxation easier.

In 1950, the Customs Cooperation Council was formed in Brussels to develop a common classification system. They created the Customs Cooperation Council Nomenclature, which was the forerunner to today’s Harmonized Commodity Description and Coding System, which began development in the 1970s to accommodate more countries and rapidly-developing technology.

Modern Classification

In 1988, countries that participated in the World Customs Organization (WCO adopted the Harmonized System (HS), and the United States enacted the Harmonized Tariff Schedule (HTSUS) on January 1, 1989.

The HTS code required for the United States shipments is a 10-digit number that includes the chapter (first two digits and main product category), the heading (second two digits and product subcategory), the subheading (digits five and six), the rate line (digits seven and eight), and the statistical reporting line (digits nine and 10).

All countries that participate in the HS use at least at least a six-digit code to identify products. Most frequently, an eight-digit code is used, but the 10-digit code gives countries more flexibility in the data they want to collect about the products entering their borders. Not every product will have a full 10-digits, but should include 10 digits on any shipping-related forms. For example, if a product doesn’t have a subcategory, two zeros should be entered in those places.

Changes to the HTS

Since 1988, the WCO has changed the HTS every five years to add new products and more precise headings and subheadings. There are approximately 300 new codes added with each update and other changes, like creating new chapters, occur when certain products become high profile, thus deserving their own code.

The WCO makes every attempt to help import businesses properly code their products, both for identification and taxation purposes. As new technologies or products emerge (such as COVID testing kits), they are added to the HTS to assist importers with proper and precise coding.

Conclusion

While it might seem like a pain to have to include a, Harmonized Tariff Schedule, or HTS, code on all your imports, it’s actually extremely valuable for both you and the government, which is why this system, or one similar to it, has been in place for nearly 75 years.

Harmonized Tariff Schedule article and permission to publish here provided by Patrick Otto. Originally written for Supply Chain Game Changer and published on June 13, 2023.

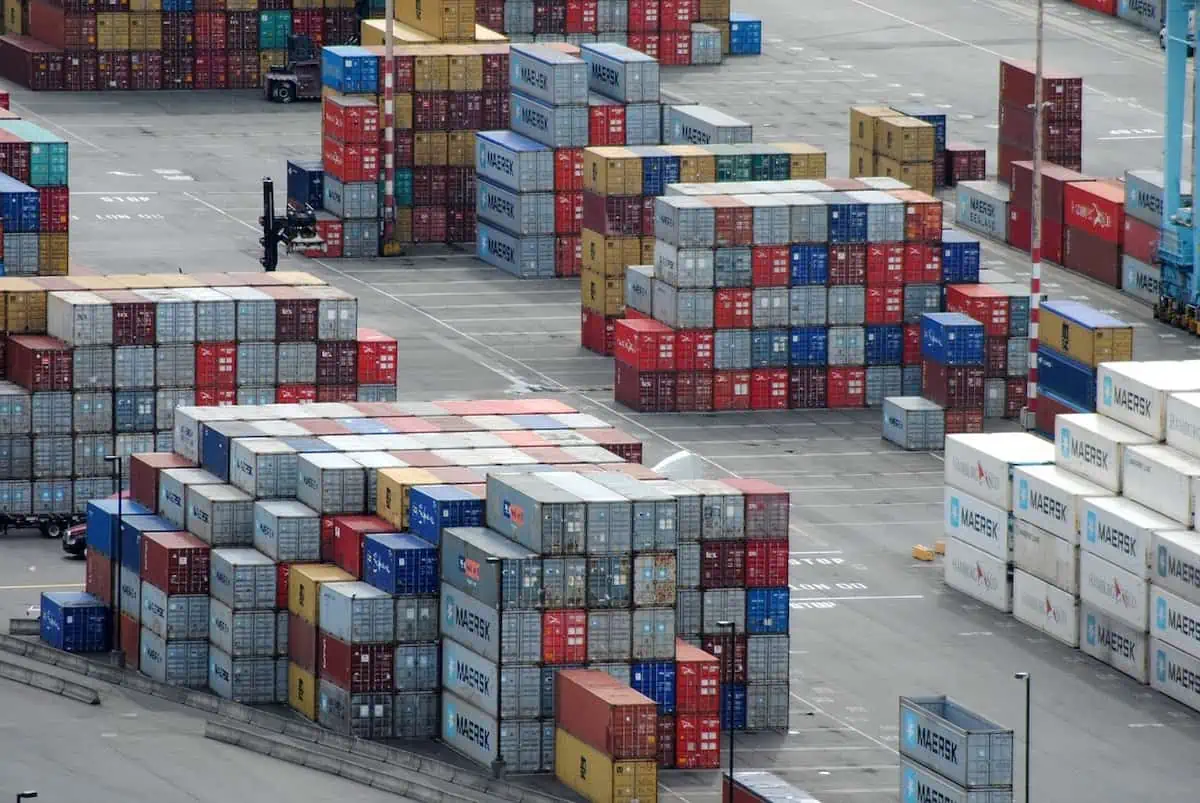

Cover image by Alex Bennett from Pixabay