Cryptocurrencies have become a focal point of the financial world due to their meteoric rise in popularity and volatility. Understanding and accurately modeling cryptocurrency returns is crucial for investors, traders, and financial analysts.

Traditional methods often fall short in capturing the intricate dynamics of cryptocurrency markets, which are characterized by extreme price fluctuations and non-normality.

This article delves deep into the subject of multivariate stable distributions and their applications in modeling cryptocurrency returns.

Start your Bitcoin trading by investing in a reliable trading platform such as immediate-growth.nl.

Understanding Cryptocurrency Returns

Historical Perspective of Cryptocurrency Returns

Cryptocurrencies like Bitcoin and Ethereum have experienced significant price swings since their inception. Early investors have witnessed remarkable returns, but this volatility has also deterred risk-averse individuals. Understanding the historical context of these returns is vital to navigate this space effectively.

Volatility and Non-Normality in Cryptocurrency Markets

Cryptocurrency markets exhibit extreme volatility, with daily price changes that can dwarf those of traditional assets like stocks or bonds. Additionally, cryptocurrency returns often deviate from the bell-shaped curve, challenging the assumptions of normal distribution.

Challenges in Modeling Cryptocurrency Returns

Modeling cryptocurrency returns presents several challenges:

- Non-Normality: Traditional models like the Gaussian distribution may inadequately capture the fat tails and skewness of cryptocurrency returns.

- Volatility Clustering: Cryptocurrency markets exhibit periods of high and low volatility, which must be accounted for in models.

- Market Sentiment: Social media and news sentiment can have a profound impact on cryptocurrency prices, making sentiment analysis crucial in modeling returns.

Multivariate Stable Distributions: An Overview

Definition and Characteristics of Stable Distributions

Stable distributions are a family of probability distributions that generalize the normal distribution. They are characterized by:

- Stability: The sum of two independent random variables following a stable distribution is also a stable distribution.

- Heavy Tails: Stable distributions can model extreme events better than the normal distribution.

- Parameters and Scaling Properties: Stable distributions are defined by four parameters, including the stability index and skewness.

Advantages Over Traditional Distributions

Stable distributions offer several advantages in modeling financial returns:

- Robustness: They are more robust in handling extreme values and outliers.

- Flexibility: They can represent both heavy-tailed and light-tailed distributions.

- Capturing Non-Normality: Stable distributions can model the non-normality observed in cryptocurrency returns more effectively.

Applications of Multivariate Stable Distributions in Finance

Portfolio Optimization with Stable Distributions

Stable distributions play a pivotal role in portfolio optimization. By accurately modeling the return distributions of various assets, investors can construct portfolios that maximize returns while managing risk.

Risk Management and Value at Risk (VaR)

Value at Risk (VaR) is a critical risk management metric. Stable distributions provide a more accurate estimate of VaR, ensuring that investors are adequately prepared for potential losses in the cryptocurrency market.

Copula Models and Dependency Analysis

Cryptocurrency returns are often correlated, and copula models using stable distributions can capture the complex dependencies between different cryptocurrencies, enhancing diversification strategies.

Tail Risk Estimation

Stable distributions are particularly adept at estimating tail risks, which are crucial in assessing the potential losses associated with cryptocurrency investments during extreme market conditions.

Estimating Multivariate Stable Distributions

Data Preprocessing and Cleaning

Before modeling, it’s essential to preprocess and clean cryptocurrency data, which may contain missing values or outliers that could significantly impact model performance.

Estimation Methods: Maximum Likelihood and Bayesian Approaches

Estimating the parameters of multivariate stable distributions can be done using maximum likelihood estimation (MLE) or Bayesian approaches. These methods help fit the distribution to the data.

Model Selection and Assessment

Selecting the appropriate stable distribution model and assessing its goodness-of-fit are vital steps in ensuring the accuracy of cryptocurrency return modeling.

Case Studies: Modeling Cryptocurrency Returns with Stable Distributions

Bitcoin and Ethereum Return Analysis

Analyzing the returns of flagship cryptocurrencies like Bitcoin and Ethereum using stable distributions provides insights into their risk and return profiles.

Portfolio Diversification Strategies

By incorporating stable distribution models, investors can develop diversified cryptocurrency portfolios that are better suited to withstand market volatility.

Risk Assessment for Cryptocurrency Investments

Stable distributions enable a more precise assessment of the risk associated with various cryptocurrencies, aiding in investment decision-making.

Comparing Stable Distributions to Other Models

Comparing stable distribution models to traditional approaches like the Gaussian distribution highlights the advantages of using stable distributions in cryptocurrency return modeling.

Challenges and Future Directions

Limitations of Multivariate Stable Distributions

While powerful, stable distributions also have limitations, such as their computational complexity and sensitivity to parameter estimation.

Data Availability and Quality Issues

Cryptocurrency data can be sparse and noisy, making it challenging to apply stable distribution models effectively.

Emerging Trends in Cryptocurrency Market Modeling

As the cryptocurrency market evolves, new trends and factors may influence return modeling, requiring continuous adaptation of modeling techniques.

Potential Innovations in Stable Distribution Models

Ongoing research may lead to innovations in stable distribution models, further improving their applicability to cryptocurrency return modeling.

Conclusion

In summary, utilizing multivariate stable distributions for modeling cryptocurrency returns provides a resilient and adaptable framework tailored to the specific intricacies of the cryptocurrency market.

An understanding of stable distribution’s historical context, inherent traits, and wide-ranging applications equips investors and analysts with the knowledge needed to make well-informed decisions within this dynamic and high-stakes environment.

As the cryptocurrency landscape continues to evolve rapidly, remaining at the forefront of cutting-edge modeling techniques, like stable distributions, becomes pivotal for achieving success and effectively managing risk. An excellent resource catering to the needs of cryptocurrency enthusiasts in this evolving landscape, offering valuable insights and a suite of tools to navigate this complex and ever-changing terrain.

Article and permission to publish here provided by Jean Nichols. Originally written for Supply Chain Game Changer and published on November 16, 2023.

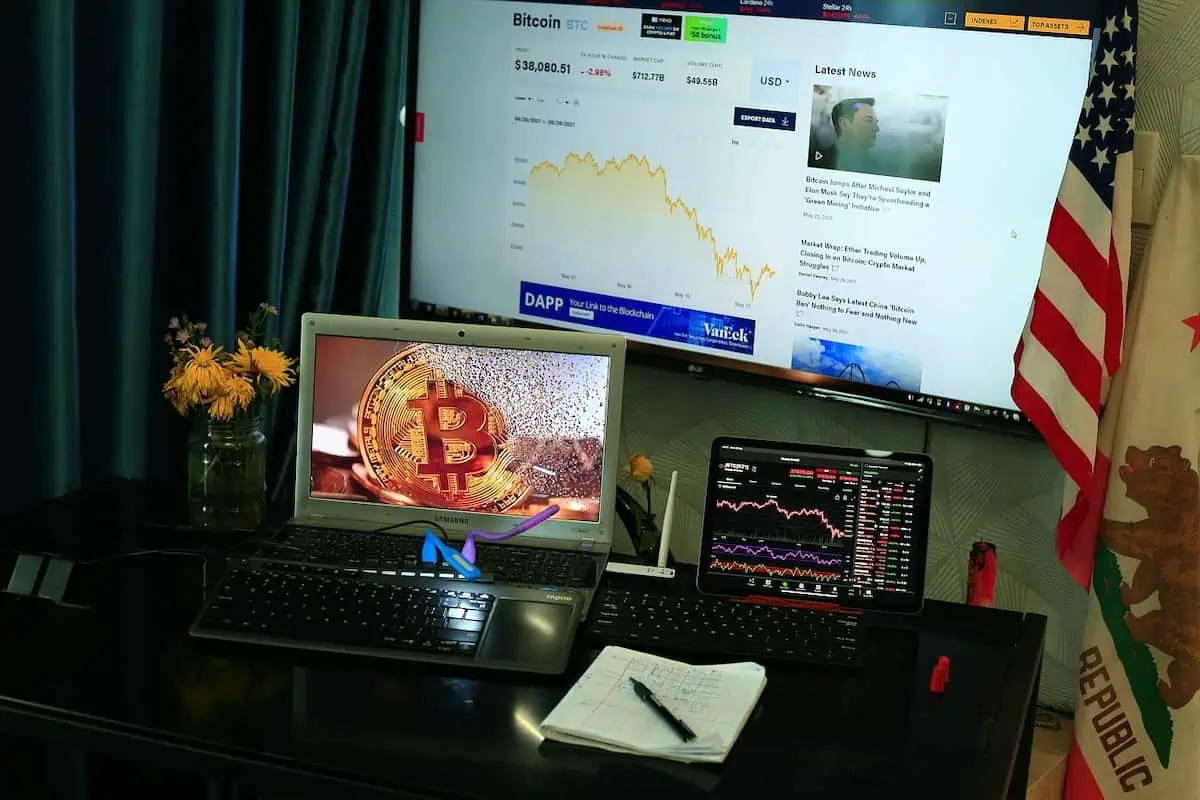

Cover image by Sergei Tokmakov, Esq. https://Terms.Law from Pixabay.